Time to get Big Business off the Dole

Ottawa's culture has changed dramatically since the 1980s. Long gone are the days when Canadians will tolerate government deficits, unrestrained spending and politicians wasting tax dollars. Yet throughout this transformation, Industry Canada has remained a bloated, intrusive, and politically-driven ministry wedded to the past. Nothing illustrates this more than a review of the department's subsidy programs, where it remains business as usual.

A new report from the Canadian Taxpayers Federation, entitled On the Dole: Businesses, Lobbyists and Industry Canada's Subsidy Programs tracks billions of dollars in handouts for the period April 1, 1982, to March 31, 2006. All said, the industry department authorized $18.4-billion in various subsidies, paid to businesses, associations and foundations in 47,960 separate grants, contributions, loans and loan guarantees from - incredibly - 150 different programs. This figure does not include subsidies from other departments, federal regional development agencies, or corporate welfare programs from other levels of government.

Of the total amount, $7.1-billion is considered repayable funding yet a paltry $1.25-billion or 17.6% has been repaid. All said, less than 7% of the total $18.4-billion subsidy portfolio has been recouped by Ottawa. Handing "free money" to businesses and failing to collect loans means fewer tax dollars for priorities like health care, infrastructure, defence or tax relief.

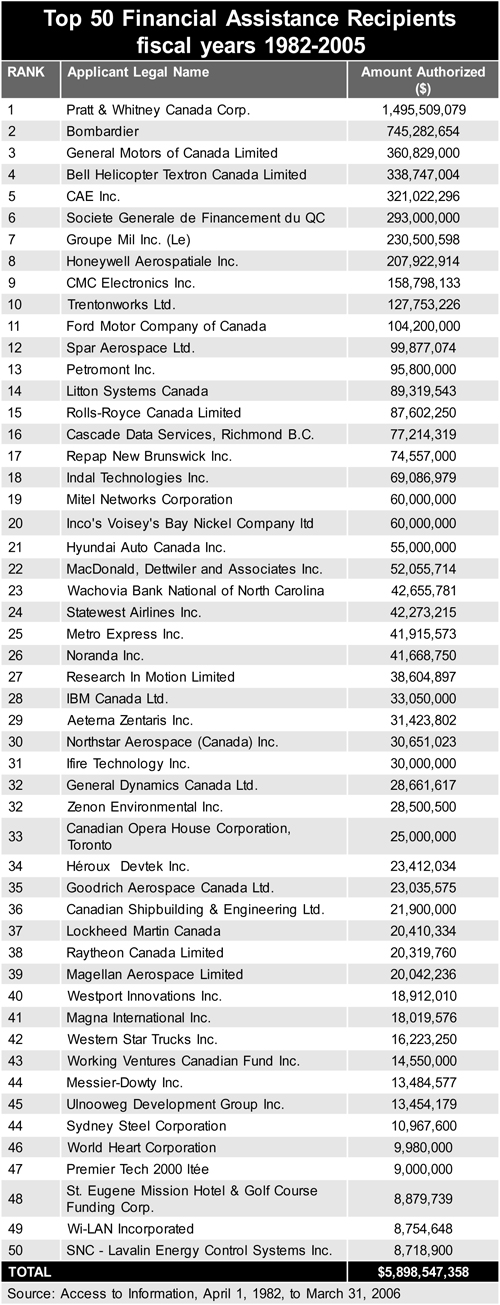

Top subsidy recipients long ago took up permanent residence at the subsidy trough and morphed from entrepreneurs to "grantrepreneurs." The top 50 beneficiaries have received $5.9-billion - a third of all money authorized. The top 5 secured more than $3.2-billion in handouts and are companies Canadians (and shareholders) know well. They are Pratt & Whitney with $1.5-billion authorized, Bombardier at $745-million, General Motors Canada with $360-million, Bell Helicopters flew away with $339-million, and CAE Inc. received $321-million.

One notable recipient is the Wachovia Bank, which received $43-million when a loan, guaranteed by the federal government, went bad. The bank is based in North Carolina. In January, 2000, Ottawa rejected a proposal to subsidize Canada's professional hockey teams after hearing from outraged taxpayers. But Canadian tax dollars are helping U.S. teams: Philadelphia's professional basketball and hockey teams play home games at the Wachovia Center.

One sorry consequence of the cosy relationship between corporations, their lobbyists and government officials is rule-breaking. Government audits reveal companies routinely paid "success fees" to lobbyists in exchange for securing subsidy handouts. These fees are prohibited by Ottawa but are paid anyway. Moreover, many lobbyists neglect to register their activities, which is another violation of accountability rules. But with Industry Canada unloading hundreds of millions of subsidy dollars annually it is no wonder the department is the most-lobbied ministry in Ottawa.

Another concern to taxpayers is the lengths politicians and bureaucrats go to avoid checks and balances when doling out loot. Almost 10% of approvals from Technology Partnerships Canada (TPC) - which is Ottawa's flagship corporate welfare program - are under the $10-million mark. Payments under this dollar amount do not require approval from the Treasury Board. Without as many hoops, the money flows quicker (albeit by smaller amounts) and there is less scrutiny over recipients.

And what have taxpayers received in return for the $3-billion doled out by TPC Ottawa originally told the public every TPC investment dollar would return $1.74 in repayments from businesses. Instead, the program's repayment rate is less than 6%. Taxpayers have recouped $169-million from this "investment." This is more proof corporate welfare programs are a sinkhole for tax dollars. Yet subsidies continue to flow unabated.

A 2005 C.D. Howe Institute study ranked Canada 30th among 36 industrialized countries in terms of combined average federal-provincial corporate income tax rates. The report also found Canada had the second highest marginal tax rate on capital. (The worst spot was reserved for Communist China.)

Rather than offer subsidies to some, the federal government should offer low business taxes for all. By getting out of the subsidy and regional development business altogether, Ottawa could save $2- to $4-billion a year. In turn, Ottawa's corporate income tax burden - which is 21% - could be reduced by 2 or even 3 percentage points. Such tax relief will benefit all companies, our domestic economy, and improve Canada's international competitiveness. It will also level the playing field, preventing the absurd situation where some businesses are forced through their taxes to subsidize their competitors.

The Ottawa-based business lobby must be challenged. Business leaders should be forced to choose between lower taxes and subsidy programs. Yet most industry groups demand politicians cut taxes and pay fat subsidies. Future corporate tax relief should be conditional on a reduction in corporate welfare.

Industry Minister Maxime Bernier stated last summer that "prosperity for all Canadians comes from markets that are allowed to move in a free, efficient and competitive manner." Yet his ministry's meddling creates an unfair, inefficient and uncompetitive marketplace.

Minister Bernier's commitment to free markets will soon be tested. He is expected to announce reforms to Ottawa's subsidy programs. His challenge is to end corporate welfare handouts, transform his department and not permit industry officials to convince him failed 19th industrial strategy is good public policy for the 21st century.

Adam Taylor is National Research Director of the Canadian Taxpayers Federation.

www.taxpayer.com